Tax havens have been linked to a whole host of dirty international affairs, so it should come as no surprise that they also appear to be indirectly subsidizing widespread illegal fishing and deforestation.

Thanks in large part to the release of classified documents in the Panama and Paradise Papers, the truth about tax havens, or the ominous sounding 'financial secrecy jurisdictions,' has slowly been rising to the surface - from money laundering, to drug and human trafficking, to financing terrorism and war crimes.

But above and beyond the economic and social repercussions, a new and ground-breaking study claims that we have been missing one of the most destructive consequences of all: the environmental impact.

The research suggests that some companies have been using tax havens to fund resource extraction from two of the most precious ecosystems on Earth – the ocean and the Amazon rainforest.

While this is not technically illegal, the authors claim that tax havens have essentially subsidized the destruction of the environment.

If you think that's a hyperbolic statement, consider this: tax havens are estimated to deprive the world of about $200 billion USD per year in global tax revenue.

The authors argue that such a substantive loss has undermined "socially and environmentally beneficial public investments," like the ones proposed in the United Nations (UN) Sustainable Development Goals and the Paris Agreement.

"The use of tax havens is not only a sociopolitical and economic challenge, but also an environmental one," lead author Victor Galaz, an expert in global environmental governance and financial systems at the Stockholm Resilience Centre, told The Guardian.

"While the use of tax haven jurisdictions is not illegal, financial secrecy hampers the ability to analyse how financial flows affect economic activities on the ground, and their environmental impacts."

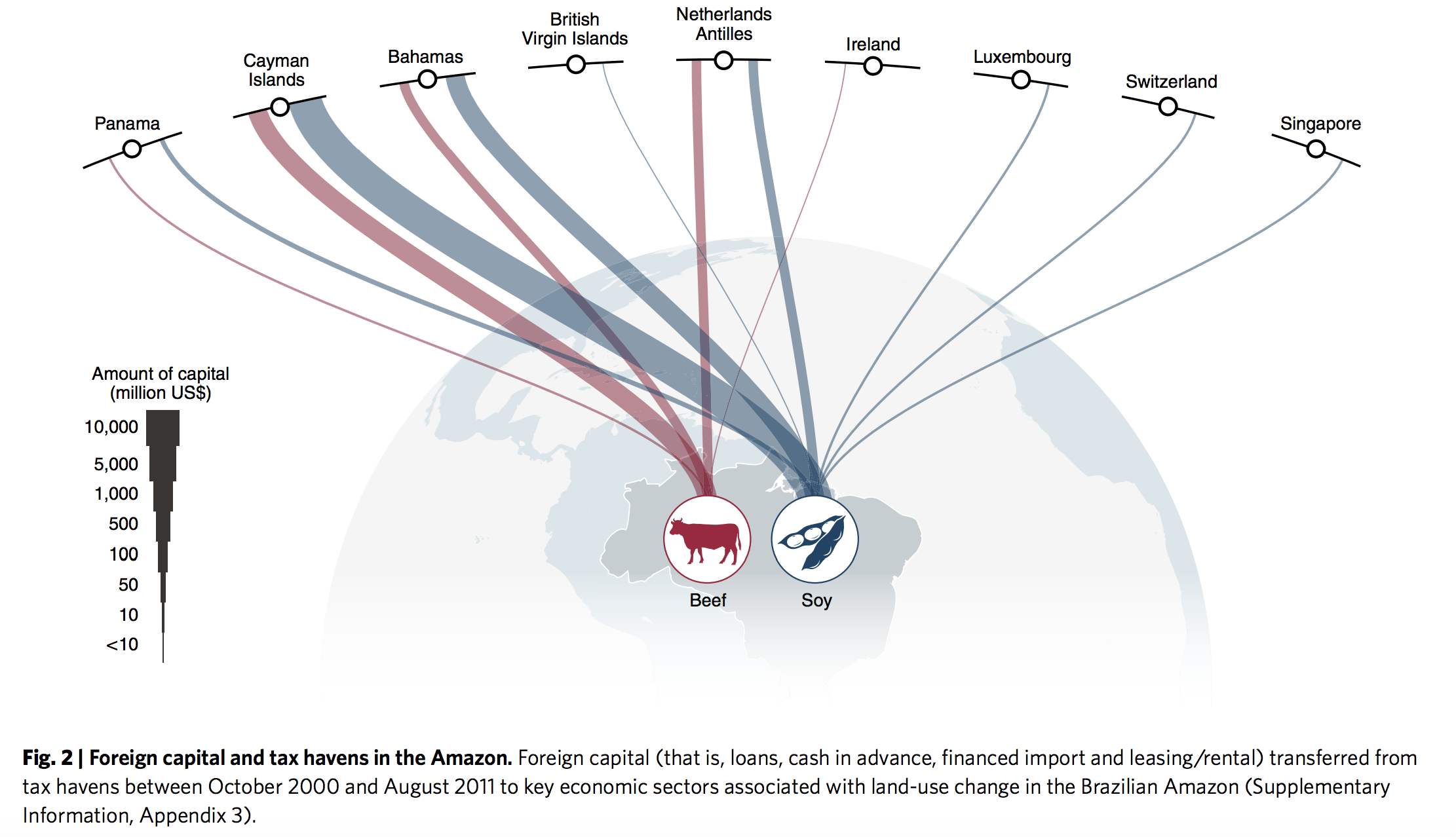

The findings reveal that between 2000 and 2011, almost $27 billion USD in foreign capital was transferred to Brazil's soy and beef sectors, according to data from the Central Bank of Brazil.

Both of these sectors are associated with deforestation for farming practices, and nearly a third of that money, or $18.4 billion, was transferred through tax havens. For some of these companies, which the study did not name, the money received through tax havens represents as much as 90 to 100 percent of their total foreign capital.

(Nature Ecology & Evolution 2018)

(Nature Ecology & Evolution 2018)

Environmentalists are calling on governments and businesses to support greater financial transparency in light of the results.

"Nature is facing unprecedented threats as we continue to take more resources from the world's richest natural areas," Andrea Marandino, a sustainable finance manager at WWF, told The Guardian.

"Tax havens make it very difficult to track international flows of capital and that means there is no accountability. If we are to secure a future for areas like the Amazon, we need to see greater corporate transparency and traceability of flows of capital around the world that fund the destruction of nature."

But it's not just the Amazon that is being put at risk from money funneled through tax havens. It appears that our oceans are also suffering.

For the very first time, the study has linked tax havens with illegal, unreported and unregulated fishing, which has been identified by the UN General Assembly as "one of the greatest threats to fish stocks and marine ecosystems."

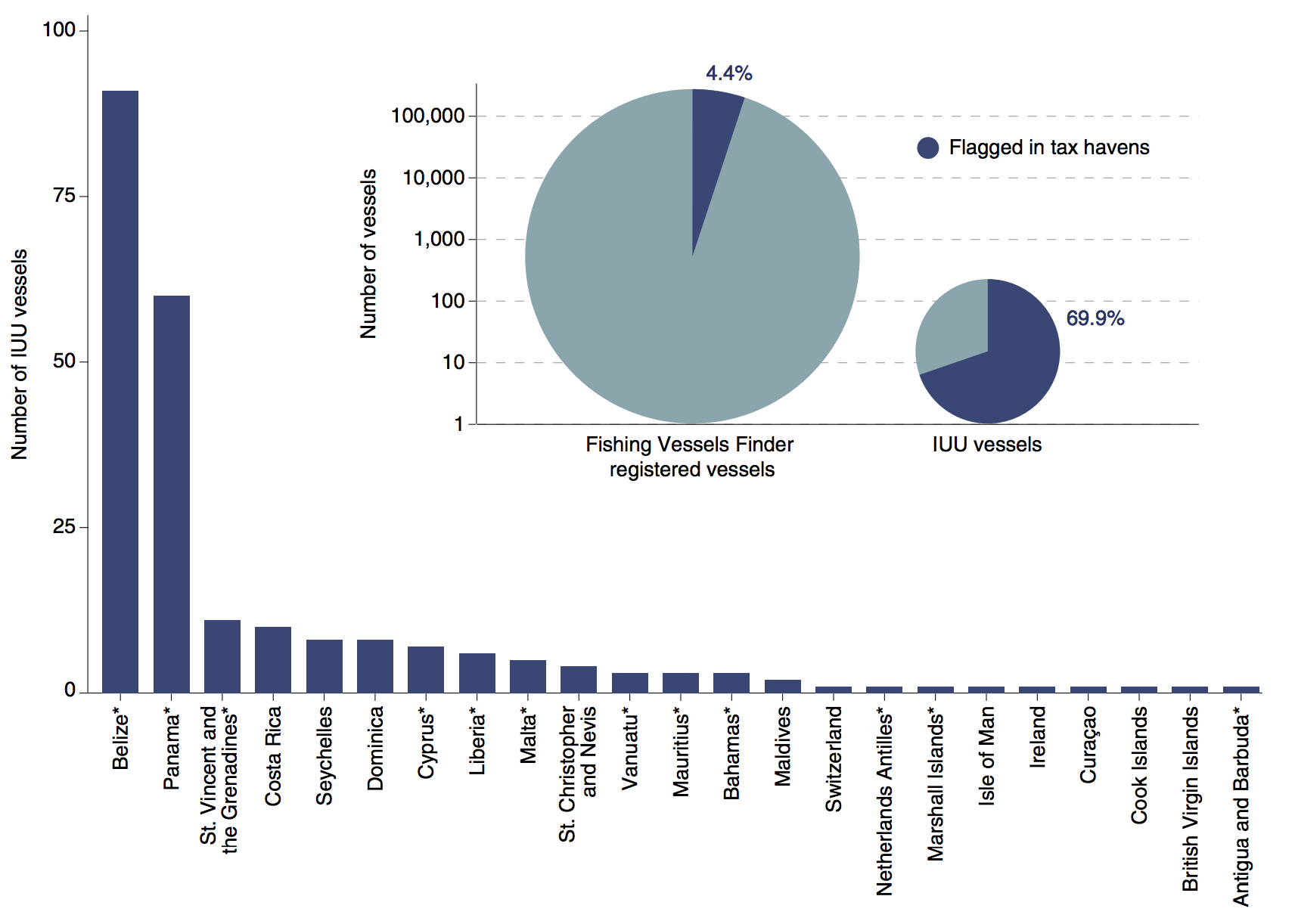

The analysis reveals that four percent of all registered fishing vessels are registered in tax havens, where governments can choose not to prosecute illegal activity on these ships. This is what is called a "flag of convenience" because the fishing vessel flies a flag of the country under which it is registered and, thus, is beholden to their legal system.

While four percent doesn't seem like much, what's happening with this particular group of fishing vessels is perturbing. The study has found that 70 percent of the known vessels involved in illegal, unreported and unregulated fishing are, or have been, flagged in a tax haven.

(Nature Ecology & Evolution 2018)

(Nature Ecology & Evolution 2018)

"The use of tax havens — and its associated problems such as loss of tax revenues, reduced transparency and lack of compliance — make tracing of fisheries resource use and allocation of accountability extremely difficult and costly," the authors explain.

"As such, it represents a major threat to the sustainability of global ocean resources that should be acknowledged and taken seriously."

As revealing as the study is, the research only draws a line between tax havens, deforestation and overfishing. Evidence that proves direct causality between tax havens and environmental degradations remains elusive amid widespread financial secrecy.

The point of the study, the authors say, is not to prosecute but rather to bring to light and quantify what has been happening behind closed doors for decades.

"We need to promote financial transparency so country by country reporting by multinationals and giving that information in the public domain will provide big benefits so we will be able to see what's happening with that capital on the ground," Galaz told the BBC.

"This is a global issue it requires international action - we need to acknowledge that tax havens as a social, economic and now environmental issue needs to be tackled globally."

The study has been published in the journal Nature Ecology & Evolution.